BCA’s API is part of BCA’s services to provide easiness on running the instruction of financial transactions, such as :

Account saving checking, checking of account mutation, transfer and etc, directly from your (platform/application/website).

BCA’s API has been used by many companies from diverse industries, ranging from offline-online, marketplace, fintech and other line of businesses.

Find out how can we provide positive contribution to the business of our customers.

What is the BCA National Open API Payment Standard (SNAP)?

SNAP is the National Open Application Programming Interface (API) Payment Standard developed by Bank Indonesia for API payments. SNAP was established by Bank Indonesia for the first time through the Decree of the Governor of Bank Indonesia Number 23/10/KEP.GBI/2021 on 16 August 2021.

The standards set by Bank Indonesia include:

Why Use the SNAP-Based BCA API?

SNAP-based BCA API makes it easy for you to be integrated with every API service provider because each provider abides by the same standards.

SNAP-Based BCA API

SNAP-based BCA API is BCA API that has been adapted to the National Open API Payment Standard set by Bank Indonesia.

Adjustments are made from the governance aspect which includes the cooperation mechanism and technical standards covering the API request and response format.

BCA API that has been SNAP standardized are:

Who Are the Users of the SNAP-Based BCA API?

SNAP-based BCA API users are BCA API users with a PJP (Payment Service Provider) license or non-PJP users who use API for the benefit of their customers. .

Do you need to migrate to SNAP?

BCA API users who have a PJP (Payment Service Provider) license or non-PJP who use the API for the benefit of their consumers can use the SNAP-based BCA API service by first submitting verification to Bank Indonesia.

Steps of Migrating to SNAP

Documents required for SNAP migration can be found here.

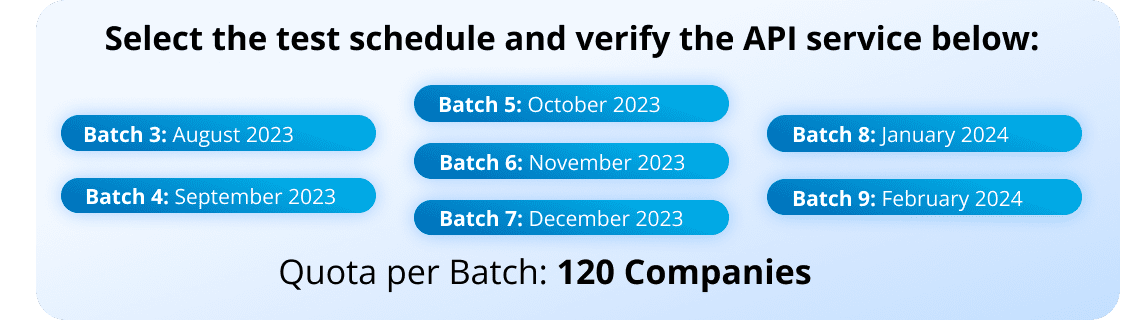

As an illustration before determining the testing time, the estimated time you need to test an API service is:

5 working days* x number of API sub services you have.

Example:

To migrate the Interbank Transfer API service, you need to develop sub services:

So, total 4 sub services and you need development duration

5 x 4 = 20 working days

*This duration is only an estimation, the duration you need may be faster or slower depending on the condition of the system you have.

You can select your Test Schedule here.

If you have not been able to schedule the migration of API BCA services to SNAP, you can confirm here.

If you have further questions regarding the SNAP-based BCA API Migration, you can contact us via api_support@bca.co.id.

Access to banking transactions and information directly from your platform to grow your business.

Ensuring your business process automation to make your operational cost more efficient.

API BCA Integration is getting easier and faster because using standardized technical integration method.

BCA API helps improve your Marketplace business efficiency by providing a better shopping experience for your customers and maintaining your business credibility. The Bank Statement and Balance Inquiry API feature simplifies your financial management process, such as real-time balance checking and transaction reports directly from your system/application.

Provide a variety of payment options for your customers through the Virtual Account API. Also, enjoy the convenience of online transfers for seller disbursement through the Intrabank and Interbank Transfer API.

Improve your business efficiency and productivity with BCA API. Provide a better experience for your customers by offering a faster debit authorization process and seamless premium payment debiting through Account Debiting Consent API and Collection API. Customers can also pay their premiums more easily with the Virtual Account API.

Get the Intrabank and Interbank Transfer API feature for faster insurance claims payment and easier vendor payment. You can also use the Bank Statement and Balance Inquiry API feature to improve your company's financial reconciliation process and integrate it directly with your system.

Increase your business efficiency with a better financial service experience through BCA API that is directly integrated with your system.

Use the Intrabank and Interbank Transfer API feature for automated fund transfers to merchants and sellers, and enjoy a fast and easy disbursement process. Check your balance and transaction history in real-time with the Bank Statement and Balance Inquiry API.

Starting to experience your business integration easiness through BCA’s API integrated financial services with competitive price. Want to get more on this? Call us here